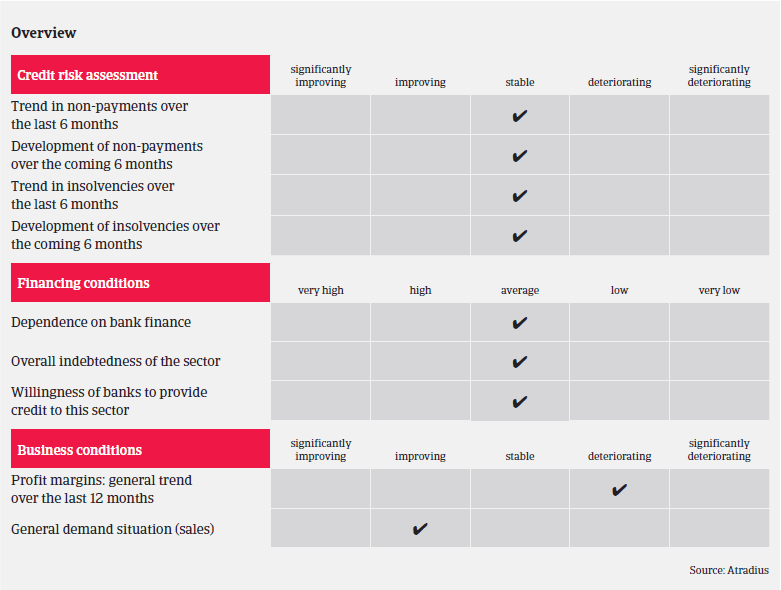

Suppliers´ margins have decreased for the last couple of years, due to higher material and labour costs, rising competition and pressure on sales prices.

- The insolvency rate remains low for the time being

- On-going consolidation process in the supplier segment

- Potential risks for smaller players are high

According to the German Automotive Association VDA, the production of German passenger cars again increased in 2015, by 1.3% to 15.1 million units. Domestic production increased 1.9%, while production abroad rose 1.0%. Turnover of the whole German automotive industry (producers and car part suppliers) increased 10% year-on-year. In the period January-August 2016 domestic car production grew 2%, while new car registrations in Germany rose 6%. This underlines the continued robust performance of the German automotive industry.

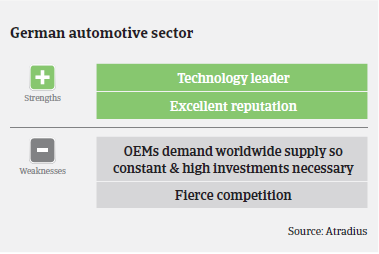

German automotive suppliers are still making good profits and, in general, their solvency and liquidity are robust. However, margins have decreased for the last couple of years, due to increased material and labour costs, rising competition and pressure on sales prices. At the same time, suppliers have to invest in engineering/production branches overseas in order to be close to original equipment manufacturers (OEM) that have relocated abroad. High capital expenditures in research and development are necessary to stay ahead of competition in new trends and technologies, i.e. electric motors, connected driving, autonomous cars. In order to stem necessary investments, increasingly size matters. Therefore, the concentration process in the German suppliers segment is on-going, while dedicated technology companies are entering the automotive market.

Given the still benign business outlook for the automotive sector, our underwriting stance remains reasonably relaxed, as it was in 2014 and 2015, especially for larger-sized, well-established suppliers, who usually have good access to capital markets and face a very low default risk.

That said, there are also a large number of small companies in the supplier subsector, which could face higher business and credit risks in the future, due to low leverage in negotiations with OEMs or if OEMs stop ordering from them (delisting). At the same time, competition is fierce in some segments. More than 50% of chassis manufacturers and electronic component providers generate revenues of less than EUR 50 million. Many small businesses have difficulties funding the investment necessary for further growth or to climb up the value chain.

While the current performance of the German car industry is still solid, any deterioration in economic performance and consumer sentiment would have direct and immediate negative effects on automotive sales, hitting mainly smaller suppliers. Given the structural vulnerability of those players, we rate the German automotive sector as “Fair”.

Relaterte dokumenter

925KB PDF