Consumption growth continues in 2016 but margins remain tight.

- Consumption growth continues in 2016

- Margins remain tight

- Payments take 60 days on average

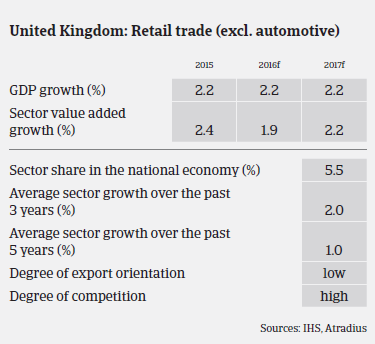

In 2015 the British non-food retail sector continued to grow, driven by a robust private consumption increase of more than 3%. According to the British statistics office ONS, the quantity bought in this segment rose 4.5% and the amount spent increased 2.6%, while average store prices decreased 1.8%.

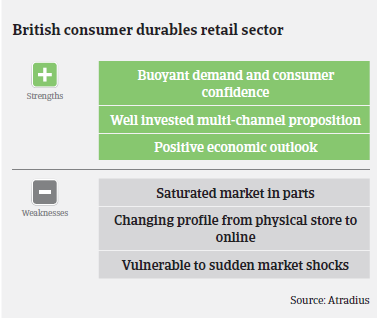

The sales outlook remains benign, with household consumption expected to increase 3% in 2016. However, further decreasing sales prices could partly offset this trend.

The retail sector experienced extremely difficult business conditions during the last economic downturn, with a sharp increase in insolvencies. Many companies could not cope with the adverse business environment, often due to an unprofitable store portfolio that retailers were unable to downsize.

Margin pressure could increase in 2016 due to the introduction of the living wage, which will increase to GBP 7.20 an hour in April 2016 and to GBP 9 by 2020.

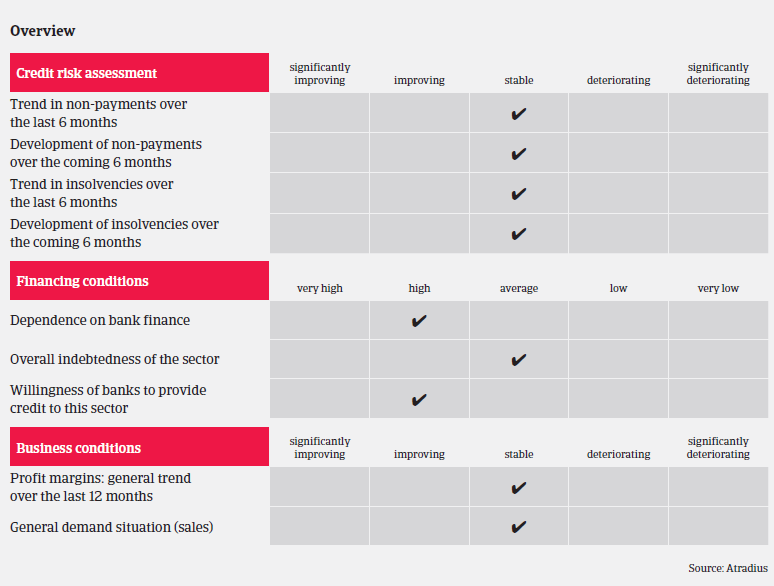

On average, payments in the consumer durables retail industry take 60 days, and we do not expect any significant increase in payment delays in the foreseeable future. The consumer durables retail sector’s default/insolvency rate is average compared to other British industries, and we do not expect a major increase. However, the fact that the British retail market remains extremely competitive, coupled with changing shopping behaviour (i.e. increasing price sensitivity and a growing share of online retail sales) indicates that insolvencies will continue to occur.

We maintain a neutral approach to underwriting in this area. Retailers are aware of credit insurance and are therefore usually willing to share confidential financial information. This enables us to make the best informed decision.

Seasonality is a major factor in the British retail sector, particularly around the Christmas period. We therefore actively encourage our customers to consider seasonal peak requirements well in advance, so that we can ensure that we are able to satisfy their demand.

Relaterte dokumenter

928KB PDF